At Quartz: Bitcoin For Your Retirement Savings?

As the price of bitcoin seems to set a new record almost every day.

People are understandably curious about how to get in on the action. And it’s not just day traders and cryptocurrency enthusiasts who are dabbling.

For the past year, BitcoinIRA has offered US retirement accounts invested entirely in bitcoin. Individual retirement accounts, or IRAs, are tax-advantaged vehicles that encourage people to set money aside for retirement. More recently, the company has expanded into accounts that also feature the newer cryptocurrency ethereum.

BitcoinIRA’s chief operating officer, Chris Kline, says monthly inflows into BitcoinIRA tripled last month, from $1 million to $3 million. Customers spans all ages, he adds.

Are they crazy? Stuffing your retirement nest egg with something as racy as bitcoin is a big gamble. Kline explained that there are two main types of investors. “For some it is speculative,” he says. These people think cryptocurrencies are the next big thing and will continue to appreciate in value. Others invest out of fear. “They are concerned about what the Federal Reserve has done to our country,” he says. “We’ve seen in Germany and Venezuela what can happen with inflation when they printed too much money.”

BitcoinIRA’s chief strategist Edmund Moy, a former director at the United States Mint, argues that bitcoin is a good hedge against the dollar: cryptocurrency prices tend to be uncorrelated with movements in the value of the dollar. Klein also considers cryptocurrencies as similarly useful alternatives to gold, another popular dollar hedge.

Setting aside hyperinflation risks, it is not clear why retirees in America need to hedge movements in the value of the dollar. The purpose of retirement investing is to build assets to spend in retirement, which is normally done in dollars. Kline points out that inflation is another thing that could erode the value of retirement portfolios. But stocks, bonds, and gold tend to outpace inflation with much less volatility.

Kline acknowledges that a bitcoin-based retirement account ideally forms part of a broader, diversified portfolio that also features more conventional assets. It is meant to offer investors access to new asset classes and methods of diversifying their savings.

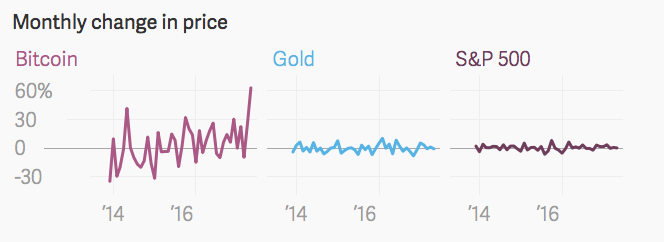

Whether it is a wise strategy depends on how concerned savers are about hyperinflation and how willing they are to tolerate extreme volatility in their portfolios. Based on bitcoin’s short history, it can certainly add something different to your portfolio. The monthly average return for bitcoin since 2010 is around 30%, compared with 1% for the S&P 500. But this comes at a cost—the standard deviation of the bitcoin price from month to month is a daunting 90%, versus around 4% for the S&P 500.

If you are saving for retirement decades down the line, the goal is a steady growth of assets that results in a reliable income when the time comes to draw down your account. Buying bitcoin is a very risky way to go about this.

Originally published at Quartz.com on March 30, 2017.

Categorised in: News